ब्लॉकचेन कैसे काम करता है?

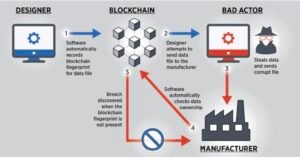

हालाँकि ब्लॉकचेन के अंतर्निहित तंत्र जटिल हैं, फिर भी हम निम्नलिखित चरणों में एक संक्षिप्त अवलोकन देते हैं। ब्लॉकचेन सॉफ़्टवेयर इनमें से अधिकांश चरणों को स्वचालित कर सकता है:

चरण 1 – लेनदेन रिकॉर्ड करें।

ब्लॉकचेन लेनदेन ब्लॉकचेन नेटवर्क में एक पक्ष से दूसरे पक्ष तक भौतिक या डिजिटल परिसंपत्तियों की आवाजाही को दर्शाता है। इसे डेटा ब्लॉक के रूप में रिकॉर्ड किया जाता है और इसमें निम्नलिखित विवरण शामिल हो सकते हैं:

इस लेन-देन में कौन शामिल था?

लेन-देन के दौरान क्या हुआ?

लेन-देन कब हुआ?

लेन-देन कहां हुआ?

यह लेन-देन क्यों हुआ?

कितनी परिसंपत्ति का आदान-प्रदान किया गया?

लेन-देन के दौरान कितनी पूर्व शर्तें पूरी की गईं?

चरण 2 – आम सहमति प्राप्त करें।

वितरित ब्लॉकचेन नेटवर्क पर अधिकांश प्रतिभागियों को इस बात पर सहमत होना चाहिए कि रिकॉर्ड किया गया लेनदेन वैध है। नेटवर्क के प्रकार के आधार पर, समझौते के नियम अलग-अलग हो सकते हैं लेकिन आमतौर पर नेटवर्क की शुरुआत में ही स्थापित किए जाते हैं।

चरण 3 – ब्लॉकों को लिंक करें।

एक बार जब प्रतिभागी सहमति पर पहुँच जाते हैं, तो ब्लॉकचेन पर लेन-देन को एक खाता बही के पन्नों के बराबर ब्लॉक में लिखा जाता है। लेन-देन के साथ, एक क्रिप्टोग्राफ़िक हैश भी नए ब्लॉक में जोड़ा जाता है। हैश एक श्रृंखला के रूप में कार्य करता है जो ब्लॉक को एक साथ जोड़ता है। यदि ब्लॉक की सामग्री को जानबूझकर या अनजाने में संशोधित किया जाता है, तो हैश मान बदल जाता है, जिससे डेटा से छेड़छाड़ का पता लगाने का एक तरीका मिलता है।

इस प्रकार, ब्लॉक और चेन सुरक्षित रूप से जुड़ते हैं, और आप उन्हें संपादित नहीं कर सकते। प्रत्येक अतिरिक्त ब्लॉक पिछले ब्लॉक और इसलिए पूरे ब्लॉकचेन के सत्यापन को मजबूत करता है। यह टावर बनाने के लिए लकड़ी के ब्लॉक को ढेर करने जैसा है। आप केवल ब्लॉक को ऊपर रख सकते हैं, और यदि आप टावर के बीच से एक ब्लॉक हटाते हैं, तो पूरा टावर टूट जाता है।

चरण 4 – खाता साझा करें।

यह प्रणाली सभी प्रतिभागियों को केंद्रीय खाता बही की नवीनतम प्रति वितरित करती है।

ब्लॉकचेन नेटवर्क के प्रकार क्या हैं?

ब्लॉकचेन में विकेन्द्रीकृत या वितरित नेटवर्क के चार मुख्य प्रकार हैं:

1–सार्वजनिक ब्लॉकचेन नेटवर्क।

सार्वजनिक ब्लॉकचेन बिना अनुमति के होते हैं और सभी को उनसे जुड़ने की अनुमति देते हैं। ब्लॉकचेन के सभी सदस्यों को ब्लॉकचेन को पढ़ने, संपादित करने और मान्य करने का समान अधिकार है। लोग मुख्य रूप से बिटकॉइन, एथेरियम और लिटकोइन जैसी क्रिप्टोकरेंसी का आदान-प्रदान और खनन करने के लिए सार्वजनिक ब्लॉकचेन का उपयोग करते हैं।

2–निजी ब्लॉकचेन नेटवर्क।

एक ही संगठन निजी ब्लॉकचेन को नियंत्रित करता है, जिसे प्रबंधित ब्लॉकचेन भी कहा जाता है। प्राधिकरण यह निर्धारित करता है कि कौन सदस्य हो सकता है और नेटवर्क में उनके पास क्या अधिकार हैं। निजी ब्लॉकचेन केवल आंशिक रूप से विकेंद्रीकृत होते हैं क्योंकि उन पर पहुँच प्रतिबंध होते हैं। व्यवसायों के लिए एक डिजिटल मुद्रा विनिमय नेटवर्क, रिपल, एक निजी ब्लॉकचेन का एक उदाहरण है।

3–हाइब्रिड ब्लॉकचेन नेटवर्क।

हाइब्रिड ब्लॉकचेन निजी और सार्वजनिक दोनों नेटवर्क के तत्वों को मिलाते हैं। कंपनियाँ सार्वजनिक प्रणाली के साथ-साथ निजी, अनुमति-आधारित सिस्टम स्थापित कर सकती हैं। इस तरह, वे ब्लॉकचेन में संग्रहीत विशिष्ट डेटा तक पहुँच को नियंत्रित करते हैं जबकि बाकी डेटा को सार्वजनिक रखते हैं। वे सार्वजनिक सदस्यों को यह जाँचने की अनुमति देने के लिए स्मार्ट अनुबंधों का उपयोग करते हैं कि क्या निजी लेनदेन पूरा हो गया है। उदाहरण के लिए, हाइब्रिड ब्लॉकचेन बैंक के स्वामित्व वाली मुद्रा को निजी रखते हुए डिजिटल मुद्रा तक सार्वजनिक पहुँच प्रदान कर सकते हैं।

4— कंसोर्टियम ब्लॉकचेन नेटवर्क।

संगठनों का एक समूह कंसोर्टियम ब्लॉकचेन नेटवर्क को नियंत्रित करता है। पूर्व-चयनित संगठन ब्लॉकचेन को बनाए रखने और डेटा एक्सेस अधिकारों को निर्धारित करने की जिम्मेदारी साझा करते हैं। ऐसे उद्योग जिनमें कई संगठनों के समान लक्ष्य होते हैं और साझा जिम्मेदारी से लाभ होता है, वे अक्सर कंसोर्टियम ब्लॉकचेन नेटवर्क को प्राथमिकता देते हैं। उदाहरण के लिए, ग्लोबल शिपिंग बिजनेस नेटवर्क कंसोर्टियम एक गैर-लाभकारी ब्लॉकचेन कंसोर्टियम है जिसका उद्देश्य शिपिंग उद्योग को डिजिटल बनाना और समुद्री उद्योग संचालकों के बीच सहयोग बढ़ाना है।

ब्लॉकचेन प्रोटोकॉल क्या हैं?

ब्लॉकचेन प्रोटोकॉल शब्द का तात्पर्य विभिन्न प्रकार के ब्लॉकचेन प्लेटफ़ॉर्म से है जो एप्लिकेशन डेवलपमेंट के लिए उपलब्ध हैं। प्रत्येक ब्लॉकचेन प्रोटोकॉल विशिष्ट उद्योगों या अनुप्रयोगों के अनुरूप बुनियादी ब्लॉकचेन सिद्धांतों को अपनाता है। ब्लॉकचेन प्रोटोकॉल के कुछ उदाहरण निम्नलिखित उपखंडों में दिए गए हैं:

The Impact of Bitcoin Halving on the Cryptocurrency Market

During a Bitcoin halving event, the number of new Bitcoins created and earned by miners is cut in half. This reduction in the supply of new Bitcoins entering the market has a direct impact on the overall supply and demand dynamics of the cryptocurrency. With fewer Bitcoins being created, the rate at which new coins are introduced into circulation slows down, leading to a potential increase in the scarcity of the digital asset.

Scarcity is a fundamental economic principle that often drives the value of an asset. In the case of Bitcoin, the limited supply of 21 million coins is one of its defining features. By reducing the rate at which new Bitcoins are generated, halving events contribute to the scarcity of the cryptocurrency, potentially driving up its value.

Historically, Bitcoin halving events have been accompanied by significant price increases. The first halving occurred in 2012 when the reward for miners was reduced from 50 to 25 Bitcoins. Following this event, the price of Bitcoin surged from around $12 to over $1,000 within a year. The second halving took place in 2016, reducing the reward to 12.5 Bitcoins. Subsequently, Bitcoin experienced a massive bull run, reaching an all-time high of nearly $20,000 in late 2017.

While past performance is not indicative of future results, many analysts and investors believe that the next Bitcoin halving event in 2024 could have a similar impact on the cryptocurrency market. The anticipation of reduced supply and potential scarcity has the potential to drive up demand for Bitcoin, leading to a price rally.

However, it is important to note that the impact of Bitcoin halving events is not solely determined by supply and demand dynamics. Market sentiment, investor behavior, and external factors such as regulatory developments and macroeconomic conditions also play a significant role in shaping the cryptocurrency market.

Furthermore, Bitcoin halving events can also have implications for the mining industry. As the rewards for miners decrease, it becomes less profitable for them to continue mining. This could lead to a consolidation of mining power in the hands of larger players with more efficient operations, potentially centralizing the network and raising concerns about decentralization.

In conclusion, Bitcoin halving events are crucial milestones in the cryptocurrency market. They have the potential to impact the supply and demand dynamics of Bitcoin, potentially driving up its value. However, the outcome of these events is influenced by various factors, and it is important to consider the broader market context when analyzing their impact on the cryptocurrency market.

Bitcoin halving is a significant event in the world of cryptocurrency that has a profound impact on the Bitcoin ecosystem. It not only affects miners but also investors, traders, and enthusiasts who closely follow the developments in the Bitcoin market.

One of the main reasons why Bitcoin halving is crucial is its direct influence on the supply and demand dynamics of Bitcoin. By reducing the mining rewards, halving ensures that the rate at which new Bitcoins are introduced into the market slows down over time. This scarcity factor is a fundamental aspect of Bitcoin’s value proposition and is often cited as one of the reasons why Bitcoin is considered a store of value, similar to gold.

When the supply of a commodity is limited, and the demand remains constant or increases, the price tends to rise. This is the basic principle of economics, and it holds true for Bitcoin as well. As the mining rewards get halved, the rate at which new Bitcoins enter the market decreases, making it harder and more expensive to acquire them.

Bitcoin halving events also have a psychological impact on market participants. The anticipation and speculation surrounding these events often lead to increased volatility in the Bitcoin price. Traders and investors try to position themselves ahead of the halving, hoping to capitalize on potential price surges. This heightened market activity can create both opportunities and risks for those involved in the Bitcoin market.

Furthermore, Bitcoin halving events have implications for the mining industry. As the rewards for mining decrease, miners need to find ways to remain profitable. This can lead to increased competition among miners, as only the most efficient and cost-effective operations can survive in the long run. Some miners may be forced to shut down their operations, while others may choose to relocate to regions with lower energy costs or more favorable regulatory environments.

Overall, Bitcoin halving is an essential event that plays a crucial role in shaping the future of Bitcoin. It not only affects the supply and demand dynamics of Bitcoin but also influences market sentiment and the profitability of mining operations. As the next halving event approaches, the Bitcoin community eagerly awaits the outcome and its potential impact on the price and the broader cryptocurrency market.

4. Network Security

Bitcoin halving also has implications for the security of the Bitcoin network. The reduction in mining rewards can potentially impact the incentive for miners to continue securing the network. With lower rewards, some miners may choose to redirect their computational power to other more profitable cryptocurrencies or even shut down their mining operations altogether. This decrease in mining activity could potentially make the Bitcoin network more vulnerable to attacks and undermine its overall security.

5. Market Volatility

Bitcoin halving events are often accompanied by increased market volatility. The anticipation and uncertainty surrounding the event can lead to significant price fluctuations. Traders and investors may react to the halving event by buying or selling Bitcoin in an attempt to capitalize on potential price movements. This increased trading activity can amplify market volatility and create both opportunities and risks for market participants.

6. Altcoin Performance

Bitcoin halving events can also have an impact on the performance of other cryptocurrencies, commonly referred to as altcoins. During periods of increased market attention on Bitcoin, altcoins may experience reduced trading volumes and price volatility as investors focus their attention and resources on the leading cryptocurrency. However, once the hype around the halving event subsides, altcoins may regain their momentum and attract renewed investor interest.

Overall, Bitcoin halving events have far-reaching implications for the cryptocurrency market. They affect supply and demand dynamics, mining economics, market sentiment, network security, market volatility, and altcoin performance. Understanding these effects is crucial for investors and market participants to navigate the ever-changing landscape of the cryptocurrency market.

Other Coin Halving Events

Bitcoin is not the only cryptocurrency that undergoes halving events. Many other cryptocurrencies, such as Litecoin, Bitcoin Cash, and Zcash, also have halving mechanisms built into their protocols. These halving events are similar to Bitcoin halving in that they reduce the mining rewards and control the supply of the respective cryptocurrencies.

Litecoin, often referred to as the “silver to Bitcoin’s gold,” has a halving event that occurs approximately every four years, similar to Bitcoin. The most recent Litecoin halving took place in August 2019, reducing the mining rewards from 25 Litecoins to 12.5 Litecoins. The next Litecoin halving is expected to occur in August 2023.

Bitcoin Cash, a cryptocurrency that split from Bitcoin in 2017, also has a halving mechanism. The first Bitcoin Cash halving event took place in April 2020, reducing the mining rewards from 12.5 Bitcoin Cash to 6.25 Bitcoin Cash. The next halving event for Bitcoin Cash is expected to occur in 2024, coinciding with the Bitcoin halving.

Zcash, a privacy-focused cryptocurrency, has a unique halving mechanism known as the “halving ceremony.” Zcash halving events occur approximately every four years, similar to Bitcoin and Litecoin. The first halving event for Zcash took place in November 2020, reducing the mining rewards from 6.25 Zcash to 3.125 Zcash. The next halving event for Zcash is expected to occur in 2024, aligning with the Bitcoin and Bitcoin Cash halvings.

These halving events have significant implications for the respective cryptocurrencies. By reducing the mining rewards, halvings effectively slow down the rate at which new coins are created. This scarcity can potentially drive up the value of the cryptocurrency as demand increases. Additionally, halvings also serve as a way to control inflation and ensure the long-term sustainability of the cryptocurrency.

Investors and miners alike closely monitor these halving events as they can have a profound impact on the market. In the months leading up to a halving, there is often increased speculation and anticipation, which can result in price volatility. After the halving, the reduced supply of new coins entering the market can lead to a supply shock, potentially driving up prices.

Furthermore, halvings also affect the mining landscape. As the mining rewards decrease, miners must adapt to the reduced income. This can lead to changes in mining strategies, such as the adoption of more efficient hardware or a shift in mining operations to regions with lower electricity costs. The profitability of mining can also be influenced by the price of the cryptocurrency, as well as the overall network difficulty.

Overall, halving events are significant milestones in the life of a cryptocurrency. They not only impact the supply and demand dynamics but also shape the future trajectory of the cryptocurrency. As the crypto market continues to evolve, it will be interesting to see how halvings play out and their effects on different cryptocurrencies.

Future of Top Ten Cryptocurrencies in 2024

The world of cryptocurrencies has been evolving rapidly, and many investors and enthusiasts are curious about the future of the top ten cryptocurrencies. While it’s impossible to predict with absolute certainty what will happen in the crypto market, we can analyze current trends and make some educated guesses about the potential future of these digital assets.

1. Bitcoin (BTC)

Bitcoin, the pioneer of cryptocurrencies, is likely to maintain its position as the leading digital currency in 2024. With its strong brand recognition and widespread adoption, Bitcoin is expected to continue to be a store of value and a medium of exchange.

2. Ethereum (ETH)

Ethereum, with its smart contract capabilities, is poised to remain a dominant force in the blockchain industry. As decentralized applications (dApps) gain more traction, the demand for Ethereum’s network is likely to increase, driving the value of ETH.

3. Binance Coin (BNB)

Binance Coin, the native cryptocurrency of the Binance exchange, has shown significant growth in recent years. With Binance expanding its services and launching new products, BNB could continue to rise in value as more users utilize the Binance ecosystem.

4. Cardano (ADA)

Cardano, known for its focus on security and scalability, has gained attention in the crypto community. With its ongoing development and improvements, ADA has the potential to become a major player in the blockchain space by 2024.

5. XRP (XRP)

XRP, the digital asset associated with Ripple’s payment protocol, has faced regulatory challenges. However, if Ripple can resolve these issues and gain wider adoption for its cross-border payment solutions, XRP could see significant growth in the coming years.

6. Dogecoin (DOGE)

Dogecoin started as a meme cryptocurrency but has gained a loyal following. While its long-term potential is uncertain, the strong community support could propel DOGE to maintain its presence in the top ten cryptocurrencies.

7. Polkadot (DOT)

Polkadot, a multi-chain interoperability platform, has gained attention for its ability to connect different blockchains. As the demand for interoperability increases, DOT could see substantial growth and become a prominent player in the crypto market.

8. Litecoin (LTC)

Litecoin, often referred to as the silver to Bitcoin’s gold, has established itself as a reliable and secure cryptocurrency. While it may not experience the same level of growth as some other cryptocurrencies, LTC is likely to maintain its position in the top ten.

9. Chainlink (LINK)

Chainlink, a decentralized oracle network, has gained popularity for its ability to connect smart contracts with real-world data. As the adoption of smart contracts increases, LINK’s value could rise, making it an attractive investment option.

10. Bitcoin Cash (BCH)

Bitcoin Cash, a fork of Bitcoin, aims to be a fast and low-cost digital currency for everyday transactions. While it faces competition from other cryptocurrencies, BCH could maintain its position in the top ten if it continues to offer practical solutions for users.

It’s important to note that the cryptocurrency market is highly volatile, and investing in cryptocurrencies carries risks. It’s always advisable to do thorough research and consult with financial professionals before making any investment decisions.

Future of Top Ten Cryptocurrencies in 2024

The world of cryptocurrencies has been evolving rapidly, and many investors and enthusiasts are curious about the future of the top ten cryptocurrencies. While it’s impossible to predict with absolute certainty what will happen in the crypto market, we can analyze current trends and make some educated guesses about the potential future of these digital assets.

1. Bitcoin (BTC)

Bitcoin, the pioneer of cryptocurrencies, is likely to maintain its position as the leading digital currency in 2024. With its strong brand recognition and widespread adoption, Bitcoin is expected to continue to be a store of value and a medium of exchange.

2. Ethereum (ETH)

Ethereum, with its smart contract capabilities, is poised to remain a dominant force in the blockchain industry. As decentralized applications (dApps) gain more traction, the demand for Ethereum’s network is likely to increase, driving the value of ETH.

3. Binance Coin (BNB)

Binance Coin, the native cryptocurrency of the Binance exchange, has shown significant growth in recent years. With Binance expanding its services and launching new products, BNB could continue to rise in value as more users utilize the Binance ecosystem.

4. Cardano (ADA)

Cardano, known for its focus on security and scalability, has gained attention in the crypto community. With its ongoing development and improvements, ADA has the potential to become a major player in the blockchain space by 2024.

5. XRP (XRP)

XRP, the digital asset associated with Ripple’s payment protocol, has faced regulatory challenges. However, if Ripple can resolve these issues and gain wider adoption for its cross-border payment solutions, XRP could see significant growth in the coming years.

6. Dogecoin (DOGE)

Dogecoin started as a meme cryptocurrency but has gained a loyal following. While its long-term potential is uncertain, the strong community support could propel DOGE to maintain its presence in the top ten cryptocurrencies.

7. Polkadot (DOT)

Polkadot, a multi-chain interoperability platform, has gained attention for its ability to connect different blockchains. As the demand for interoperability increases, DOT could see substantial growth and become a prominent player in the crypto market.

8. Litecoin (LTC)

Litecoin, often referred to as the silver to Bitcoin’s gold, has established itself as a reliable and secure cryptocurrency. While it may not experience the same level of growth as some other cryptocurrencies, LTC is likely to maintain its position in the top ten.

9. Chainlink (LINK)

Chainlink, a decentralized oracle network, has gained popularity for its ability to connect smart contracts with real-world data. As the adoption of smart contracts increases, LINK’s value could rise, making it an attractive investment option.

10. Bitcoin Cash (BCH)

Bitcoin Cash, a fork of Bitcoin, aims to be a fast and low-cost digital currency for everyday transactions. While it faces competition from other cryptocurrencies, BCH could maintain its position in the top ten if it continues to offer practical solutions for users.

It’s important to note that the cryptocurrency market is highly volatile, and investing in cryptocurrencies carries risks. It’s always advisable to do thorough research and consult with financial professionals before making any investment decisions.